Financial Review

Harvey Mudd continues to maintain positive operating results, which demonstrates the College’s strong budgetary measures to meet institutional goals. Endowment returns for the past fiscal year increased due to positive performance results from underlying investment asset classes. The College’s administration and trustees will continue to strengthen financial resources while monitoring the changing economic and political landscapes both domestically and globally. The past fiscal year has seen exciting new additions to Mudd’s leadership, faculty and staff, and with continued support from community members, positive financial outlooks are projected in the coming years.

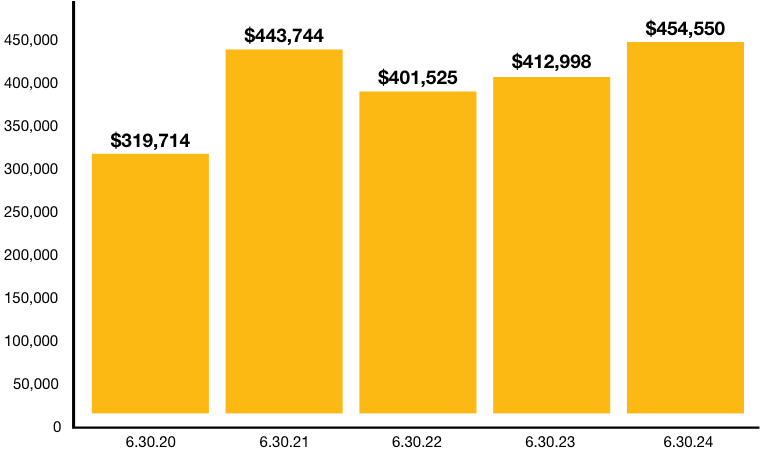

Endowment Market Value

(In thousands)

$455 Million

JUNE 30, 2024

Statement of Activities

Revenue

| Category | 2024 | 2023 |

|---|---|---|

| Tuition, fees, room and board | $78,127 | $73,762 |

| Less financial aid | ($22,451) | ($21,577) |

| Net student revenues | $55,676 | $52,185 |

| Federal grants | $4,565 | $5,142 |

| Private gifts and grants | $12,487 | $19,091 |

| Private contracts | $1,639 | $1,729 |

| Endowment payout | $17,531 | $16,561 |

| Other revenue | $3,437 | $2,262 |

| Total Revenue | $95,335 | $96,970 |

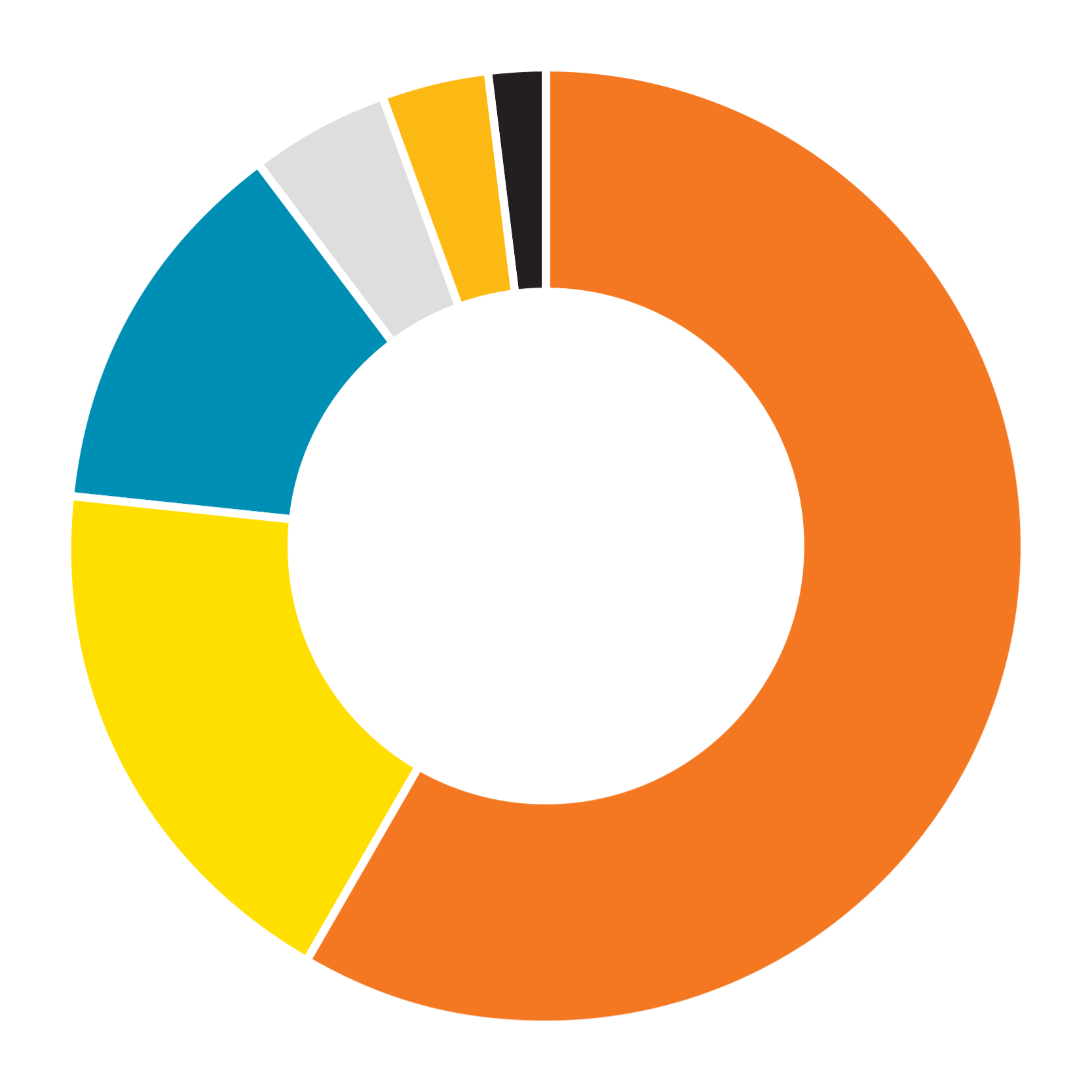

- Net student revenues, 58.4%

- Endowment payout, 18.4%

- Private gifts and grants, 13.1%

- Federal grants, 4.8%

- Private contracts, 1.7%

- Other revenue, 3.6%

Expenses

| Category | 2024 | 2023 |

|---|---|---|

| Instruction | $34,548 | $34,142 |

| Research | $4,627 | $4,366 |

| Public service | $855 | $785 |

| Academic support | $7,914 | $7,703 |

| Students services | $10,008 | $9,591 |

| Institutional support | $15,369 | $14,566 |

| Auxiliary enterprises | $13,352 | $12,993 |

| Total Expenses | $86,673 | $84,146 |

| Total Expenses | $86,673 | $84,146 |

|---|---|---|

| Excess revenue over expenses | $8,662 | $12,824 |

| Polled investment gains (losses), net of endowment payout | $33,336 | $1,835 |

| Other changes in net assets | ($131) | $471 |

| Change in net assets | $41,867 | $15,130 |

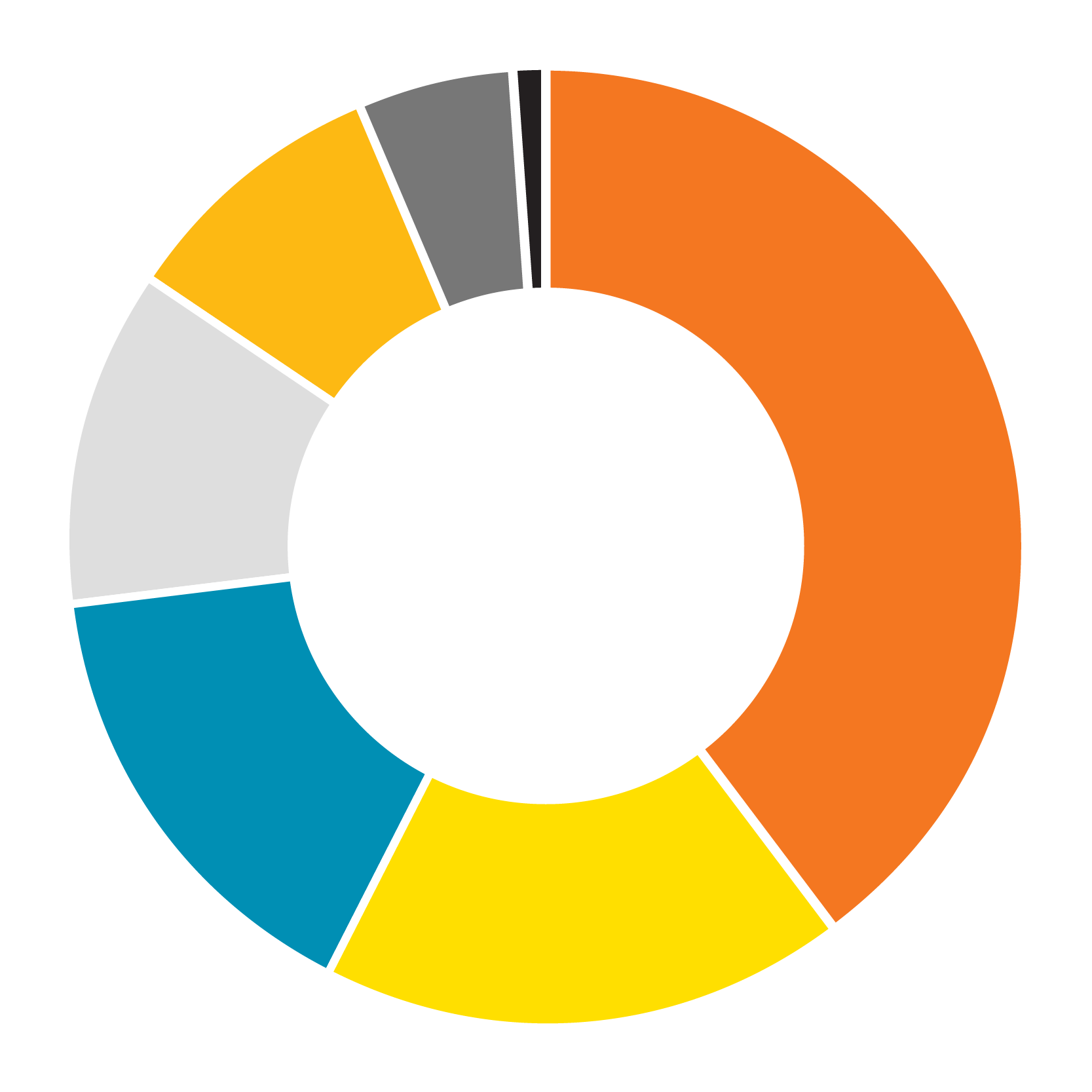

- Instruction, 39.9%

- Institutional support, 17.7%

- Auxiliary enterprises, 15.4%

- Student services, 11.5%

- Research, 5.3%

- Academic support, 9.1%

- Public service, 1.0%